92% of Mortgaged Properties Have Equity

More home owners now have equity.

About 46.7 million residential properties with a mortgage had equity at the end of the first quarter of 2016, according to data from CoreLogic. Home equity rose year-over-year by $762 billion.

In the first quarter alone, 268,000 home owners regained equity, which boosted the percentage to 92 percent of all mortgaged properties with equity.

“In just the last four years, equity for home owners with a mortgage has nearly doubled to $6.9 trillion,” says Frank Nothaft, chief economist for CoreLogic. “The rapid increase in home equity reflects the improvement in home prices, dwindling distressed borrowers and increased principal repayment. These are all positive factors that will provide support to both household balance sheets and the overall economy.”

More than 1 million home owners have escaped the negative equity trap over the past year, adds Anand Nallathambi, president and CEO of CoreLogic.

“We expect this positive trend to continue over the balance of 2016 and into next year as home prices continue to rise,” says Nallathambi. “If home values rise another 5 percent uniformly across the U.S., the number of underwater borrowers will fall by another one million during the next year.”

Still, 4 million — or 8 percent of all homes with a mortgage — remain in negative equity territory. But the number of negative equity properties has been steadily dropping. In comparison to the fourth quarter of 2015, negative equity properties dropped 21.5 percent year-over-year.

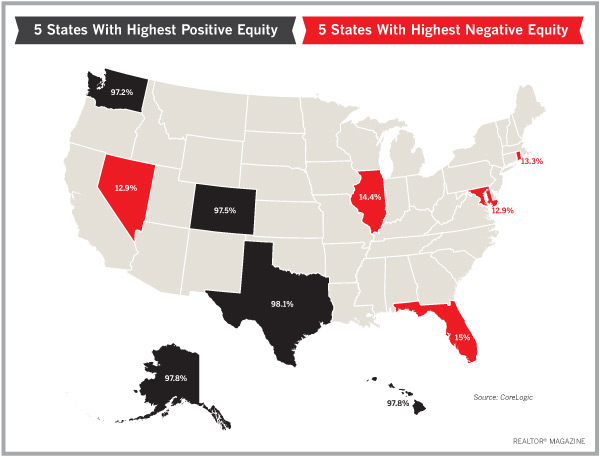

Five states accounted for 30.2 percent of negative equity in the U.S. The states with the highest percentage of homes in negative equity are: Nevada (17.5%); Florida (15%); Illinois (14.4%), Rhode Island (13.3%); and Maryland (12.9%).

On the other hand, the states with the highest percentage of homes with positive equity in the first quarter are: Texas (98.1%); Alaska (97.8%); Hawaii (97.8%), Colorado (97.5%); and Washington (97.2%).

Source: CoreLogic

Join The Discussion